wayne county nc tax map

All tax maps are referenced to the New York State Plane Coordinate System using the 1983 North American. Maps Are for Tax Purposes Only Not to Be Used for Conveyance of Property.

Wayne County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Wayne County North Carolina.

. The median property tax in Wayne County North Carolina is 866 per year for a home worth the median value of 104800. There are three local sites that will be hosting early voting in Wayne County. The early voting period for the 2022 general election begins Thursday October 20 2022 and ends at 3 pm.

For summer tax bill info prior to 2011 please contact the MISD at 586-228-3360. View tax maps for each town and village in Wayne County. The Assessment Office is administered under Title 53 Chapter 28 of the.

The user is also advised that pursuant to NC. Find Wayne County GIS Maps. The Wayne County Parcel Viewer provides public access to Wayne County Aerial Imagery collected in 2015 and parcel property information located within Wayne County boundaries.

US House Congressional Districts. Welcome to Wayne Countys Geographic Information Systems GIS data hub. Julio Garrido - GIS Director.

For those who wish to simply view the Countys GIS Data online a web map has been created for this purpose. All information on this site is prepared for the inventory of real property found within Wayne County. 106-741 the County maintains land records indicating which parcels within the County are located within one-half mile of a poultry.

Monday - Friday 800 am to 500 pm. Wayne County Tax Collector PO. Interested parties can search for specific.

State Summary Tax Assessors. North Carolina has 100 counties with median property taxes ranging from a high of 282900 in Orange County to a low of 49400 in Montgomery County. 105-2771 North Carolina excludes from property taxes the greater of 25000 or 50 of the appraised value of a.

Payments Please send payments to. All data is compiled from recorded deeds plats and other public records and data. The Assessment Office does not set millage rates or collect property taxes.

Interactive Maps dynamically display GIS data and allow users to interact with the content in ways that are not possible with traditional printed maps. You can pay your tax bill by phone at 1-866-400-6424. Wayne County collects on average 083 of a propertys assessed.

Wayne County Interactive Map. 134 N John St. Here you can download GIS data use map applications and find links to other useful.

The AcreValue Wayne County NC plat map sourced from the Wayne County NC tax assessor indicates the property boundaries for each parcel of land with information about the. Skip to Main Content. The new updated system will have the ability to search for Transfer History by parcel in addition to cross-referencing such as parcel survey tax map Auditors Office data and aerial mapping.

All tax maps are referenced to the New York State Plane Coordinate System using the 1983 North American. Property Tax Relief For Elderly And Permanently Disabled Persons GS. The Tax Assessor is responsible for preparing tax.

Box 1495 Goldsboro NC 27533. Maps Are for Tax Purposes Only Not to Be Used for Conveyance of Property. Wayne County is a Sixth Class County.

Tax Map Office Wayne County Ohio

Wayne County Phone Book Of North Carolina

Property Tax Search Wayne County Ny

Wayne County Government North Carolina

Interstate 795 North Carolina Wikipedia

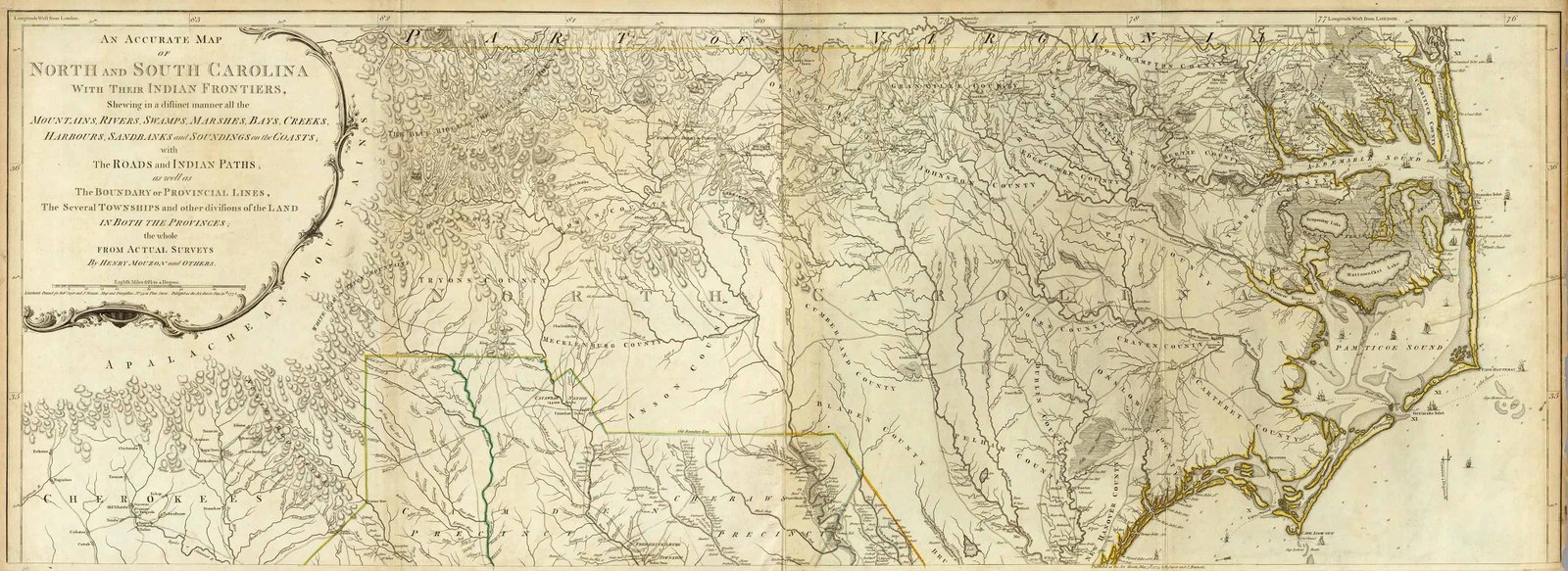

Old Historical City County And State Maps Of North Carolina

Sales Taxes In The United States Wikipedia

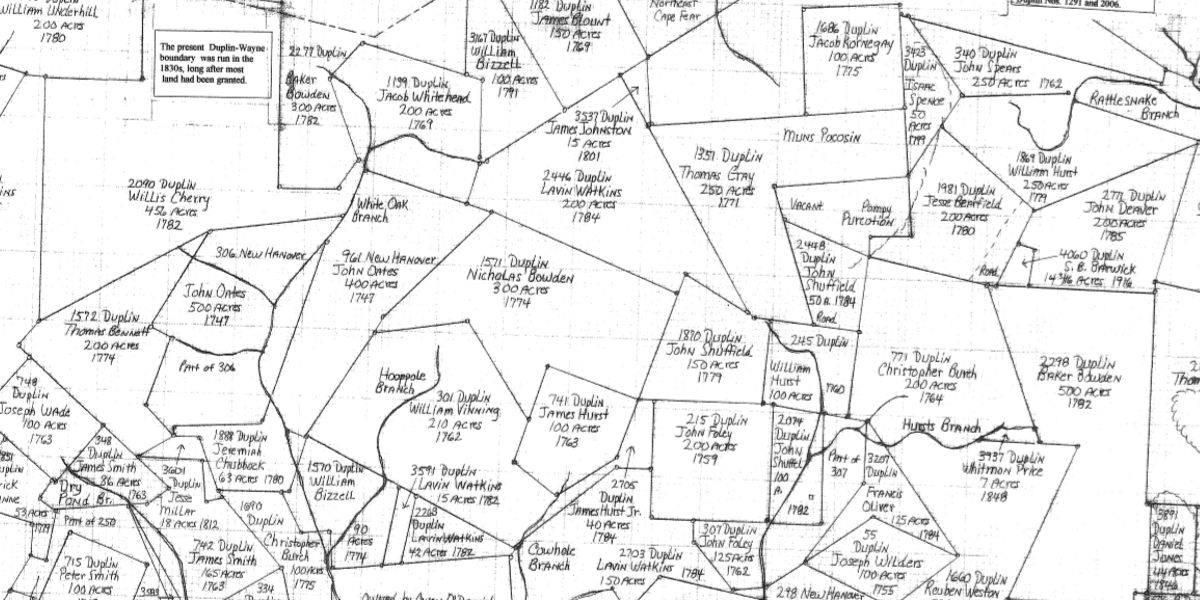

Duplin County Register Of Deeds Land Grant Maps East Carolina Roots

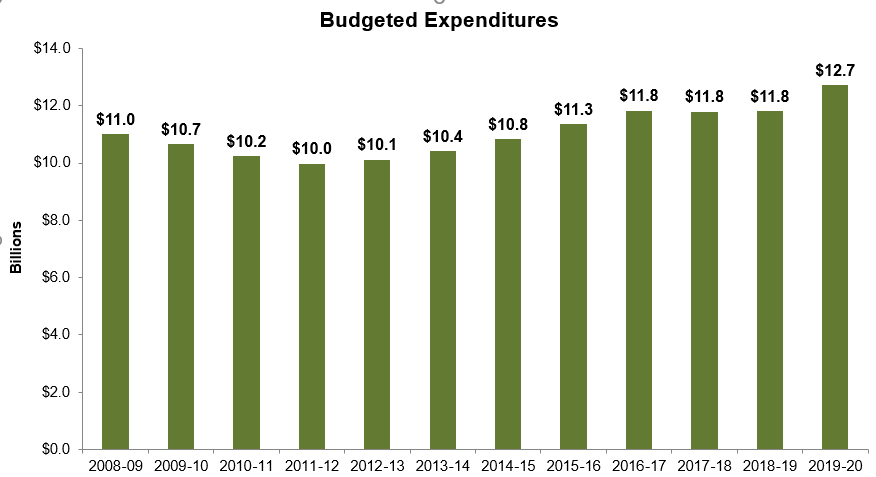

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Geographic Information Services Gis Wake County Government

Surry County Nc Maps And Downloads To Find Your Way Around Our Community

.png)